montana sales tax rate 2021

The Sheridan sales tax rate is. Did South Dakota v.

States With Highest And Lowest Sales Tax Rates

Montana Individual Income Tax Resources.

. Montana Personal Income Tax rate system is made up of seven individual brackets from 1 to 69. Ad Lookup Sales Tax Rates For Free. Rates last changed.

7 rows The Montana State Tax Tables for 2021 displayed on this page are provided in support of the. An example of calculating your Montana property taxes is owning a property with an assessed value of 250000. Wayfair Inc affect Montana.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Montana charges no sales tax on purchases made in the state. Montana does not impose a state-wide sales tax.

The state sales tax rate in Montana is 0000. Although the lowest rate rises to 47 percent up from 10 percent conforming to the federal standard deduction 12400 last year compared to Montanas current standard deduction of 4790 yields tax savings for low-income taxpayers as well. Vehicle owners to register their cars in Montana.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The State of Montana imposes a variety of registration fees on motor vehicles trailers and recreational. 38 rows 2021 Local Sales Tax Rates.

The minimum combined 2022 sales tax rate for Sheridan Montana is. The five states with the highest average local sales tax. 2 Accommodation charges do not include charges for rooms used for purposes other than lodging Section 3.

There is no state sales tax in Montana. Millage rates vary based on your location. The Montana sales tax rate is currently.

The current total local sales tax rate in Belgrade MT is 0000. Montana MT Sales Tax Rates by City. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

And while more people are moving to or live in the south and pay lower property taxes compared to residents of northern states they pay some of the highest state and local sales tax rates in the US. There are no local taxes beyond the state rate. In effect that lowers the top capital gains tax rate in Montana from 69 to 49.

The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data. 1 There is imposed on the user of a facility accommodations a tax at a rate equal to 4 of the accommodation charge collected by the facility sales price paid by the purchaser. Montana State Taxes 2020 2021 Montana State Taxes.

Montanas top rate 69 is levied when a persons income is beyond 14900. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. Besides the applicable tax rate you must consider any applicable millage rates.

This is the total of state county and city sales tax rates. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return. The December 2020 total local sales tax rate was also 0000.

Montana Salary Tax Calculator for the Tax Year 202122 You are able to use our Montana State Tax Calculator to calculate your total tax costs in the tax year 202122. Interactive Tax Map Unlimited Use. These tax rates are taxes imposed per thousand of assessed value.

Personal Income Excise Sales Property Corporate Severance Inheritance Taxes. Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. Did South Dakota v.

Montana local resort areas and communities are authorized. Montana Department of Revenue. In 2020 Montana ranked 26th in 2019.

The Billings sales tax rate is. The sales tax rates of the other states are inclusive of only level rates. Its sales tax from 595 percent to 61 percent in April 2019.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. The Montana sales tax rate is currently. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

The cities and counties in Montana also do not charge sales tax on general purchases so the state enjoys tax free shopping. The credit is equal to 2 of all net capital gains listed on your Montana income tax return. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to.

Montana Nebraska Nevada New Hampshire. However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a lodging facility use tax and a limited sales and use tax on the base rental charge for rental vehicles. Montana Individual Income Tax Resources.

Any locally imposed state-sales tax rates in the other states are not included in the rates Indiana dealers will be required to. Exact tax amount may vary for different items. This is the total of state county and city sales tax rates.

You would need to multiply this value by the. 2262021 30828 PM. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. As of July 2021 four of the five states with the highest average combined state and local sales tax rates were in the south. 2022 Montana state sales tax.

Section 15-65-112 MCA is amended to read. Wayfair Inc affect Montana. Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis.

The County sales tax rate is. The County sales tax rate is. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

The minimum combined 2022 sales tax rate for Billings Montana is. AUGUST 31 2021.

Sales Taxes In The United States Wikiwand

Montana State Taxes Tax Types In Montana Income Property Corporate

Ranking State And Local Sales Taxes Tax Foundation

Tax Rates To Celebrate Gulfshore Business

How Do State And Local Sales Taxes Work Tax Policy Center

Montana Sales Tax Rates By City County 2022

How To Charge Sales Tax And Shipping For Your Online Store Hostgator

Montana State Taxes Tax Types In Montana Income Property Corporate

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

Monday Map State And Local Sales Tax Collections Tax Foundation

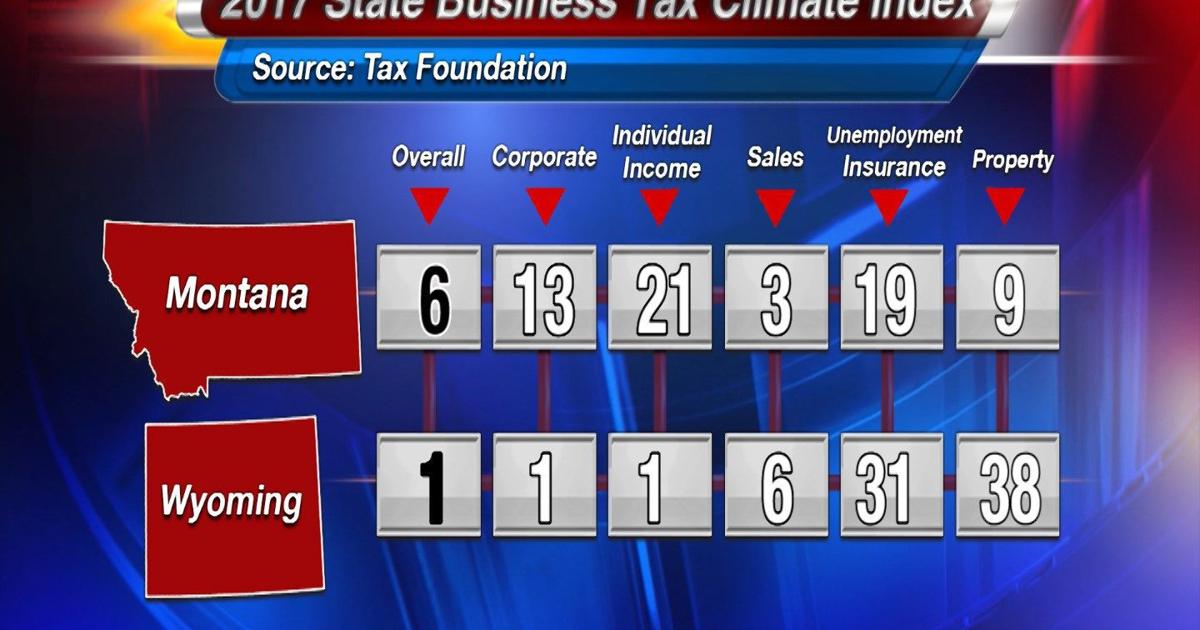

Montana And Wyoming Rank In Top 10 For Taxes News Kulr8 Com

Sales Tax On Saas A Checklist State By State Guide For Startups

U S Sales Taxes By State 2020 U S Tax Vatglobal

Historical Montana Tax Policy Information Ballotpedia

Montana Income Tax Information What You Need To Know On Mt Taxes

Updated State And Local Option Sales Tax Tax Foundation

Sales Tax Expert Consultants Sales Tax Rates By State State And Local Rates